Publishing Overview

Information is constantly evolving, so we obsess about staying current to provide you with the best resources when making major insurance decisions for your firm. You'll find us in numerous print and online publications.

CPA Practice Advisor

“By best estimates, we still have at least a decade or two until computers replace humans in jobs that are exceedingly complex and require higher order decision making or forecasting skills. Until your entire audit department is replaced by a single computer, you are still going to need people to fill those seats. Before we delve into the future of hiring, it’s worth discussing first why the traditional hiring methods you’re currently using are scientifically irrelevant.”

The Cost of Collecting Driver's License Numbers

March 2017 online, July 2017 print

The IRS is now recommending that taxpayers use their driver’s license number to provide another layer of security when electronically filing a federal tax return. Most CPA firm staff and clients have been trained to treat SSNs with exception care, but the same has not been true with driver’s license numbers (DLNs). While the reasons for that are understandable, the increased relevance placed upon DLNs has made them a new high value item for criminals and CPA firms alike. As with many other “good ideas,” the unintended consequences may make this initiative more harmful than helpful.

Paying Tax Penalties? Stop Voiding Your Policy!

December 2016, online

As Tax Season looms closer, it’s worth having a quick discussion with the partner group on your firm’s policy for paying client’s tax penalties. Why should you have this discussion immediately? Failure to properly report and receive clearance from your insurer can void your policy on that issue! Tax penalties tend to make unhappy clients and unhappy clients tend to bring claims. Claims also make unhappy partners, but having a claim with no insurance coverage will be exceedingly painful. Tax claims are the most frequent type of claim, so it’s worth being savvy in this area.

CALCPA

What CPAs Need to Know About Cyber Insurance

September 2017, print & online

“Daniel W. Hudson and Joseph E. Brunsman are graduates of the United States Naval Academy who, after serving in the Navy, founded a brokerage in 1995 specializing in practice insurance for CPA firms. ”Our goal is to fundamentally change the way that CPA firms purchase and utilize their insurance on a national level,” says Brunsman, who wrote a book on the topic with Hudson. The book, “True Course,” came to our attention via our own insurance gurus at CAMICO. We drilled a little bit deeper with the authors to find out more about why they wrote the book and the importance of CPA insurance.”

What CPAs Need to Know About Cyber Insurance

March 2017, print & online

No business of any kind can operate in the modern digital environment without some risk of cyber attack or data breach. CPA firms are especially vulnerable due to the volume of records they contain, often containing sensitive personal and financial information. Insurance companies are increasingly offering solutions for CPA firms that need coverage against cyber attacks. This article describes the most common type of attach--ransomeware--and it's potential costs, providing guidance on how to calculate coverage, along with tips and traps for potential buyers.

What the CIA Can Teach your Firm About Recruiting More Women

January 2018

Whether it’s in books or movies, the CIA has a certain reputation for intrigue and danger. Humorously, the CIA’s FAQ section on their website includes answers to questions such as, “Who is a spy? Are there secret agents like James Bond with secret gadgets?”, and, “The CIA has been accused of conducting assassinations and engaging in drug trafficking. What are the facts?” We find it unlikely that very many women, or for that matter any men, would find entertain the idea of becoming the next government sponsored Pablo Escobar.

Indeed, the perceptions of the CIA were so poor with women, they commissioned a million-dollar study on the topic. They wanted to know how women viewed their organization, and what steps were needed to overcome that perception in the hiring process. With women now comprising roughly half of all accounting graduates, taking these lessons from the CIA into the next hiring season can result in significant strategic advantages for your firm.

Below are selected perceptions of how women, not yet affiliated with the CIA, viewed the agency. We think you will find the parallels between the CIA and how the public generally view CPAs, uncanny.

Advantages

- The CIA is a prestigious place to work.

- The opportunity to travel is appealing to some.

Disadvantages

- Fear that the job will be intrusive on an employee’s family life.

- Perception that you must make a lifetime commitment to the agency.

- Need to relocate to Washington, D.C.

- Lengthy hiring process.

- Perception that the culture is still very male-dominated and is comprised of white men in suits who are very reserved, but intelligent.

With these perceptions in mind, the CIA enumerated detailed numerous steps and suggestions on how to optimize the hiring process of women. Due to the parallels in perception, CPA firms can likewise take advantage of the CIA’s suggestions to increase their odds of hiring women.

Refine and Enhance Your Recruiting Location

In the study segment known as, “Overview of the Target,” the CIA noted that women first look online at sites such as Monster.com, Career Builder, Linkedin, and Facebook for employment opportunities. Likewise, younger women in college often rely on their career counselors and local career fairs to find opportunities.

If you haven’t already, now would be a good time to start solidifying the relationships you firm has with career counselors at nearby colleges. Ask them about guest lecturing opportunities, or alumni association speaker openings. Many colleges also have online career centers where you can post internship opportunities. If that is impractical or already successful, consider expanding your online presence with the websites listed.

While the CIA needs to cast a wide net for potential recruits, your firm can refine its search to more accounting specific websites. Once such website is AccountingFly. Not only can you hire remote workers and bookkeepers, but more specific qualifications can also be requested. You also have the option to request permanent placements. With an advertised one million active candidates and two hundred thousand passive candidates, you can easily, and economically, leverage the internet to massively expand your presence.

Determine Who to Send

The CIA recommended that they send female recruiters to speak with female prospects. This may seem trivial, but according to the 2004 medical study, What men and women value at work: Implications for workplace health, “[M]en underestimate and are generally unaware of women’s work-related values.” Given the standard perceptions of the CIA and CPA firms as being male dominated, this can be another ground level advantage for your firm. They noted that female employees make women, “more comfortable and confident” when considering a job at their agency.

If you have an outgoing female partner, it only makes sense to leverage their internal successes at your firm with external successes in the job market. Also, if any of your staff are recent female graduates from the area you’re marketing to, considering asking them for referrals to any acquaintances in the accounting major. Better yet, take them to career fairs to help with the process.

You can also consider using your entire existing workforce as a referral recruitment tool. Accenture is a professional services company that proactively offers bonuses to employees for referral hires. Not only did their referral program become their number one source of candidates, but it also saved them EUR

600,000 in 3 months and resulted in a 30% higher response rate when compared to the Managing Director. Not to be outdone, Intel Corporation is offering a double bonus to employees who refer women, as well as minorities and veterans.

Know Your Selling Points

According to the CIA study, women most often mentioned salary as the single most influential factor when defining a rewarding job. Additionally, they also valued health care benefits, vacation/sick leave, and education benefits. However, speaking about these issues will likely put you in the same arena as every other CPA firm out there; including the Big 4 recruiting machine.

But all is not lost. Their study also mentioned several intangible benefits that were cited as being very important to women. These included a flexible work schedule, work/life balance, a job located close to their home, and a collaborative and supportive environment.

Meredith York, an economist at Meredith College, added clarity to these differing preferences. Per York, most women will remain the primary parent within the household and remain responsible for most household tasks. With this understanding, the value women place on even intangible benefits makes perfect sense.

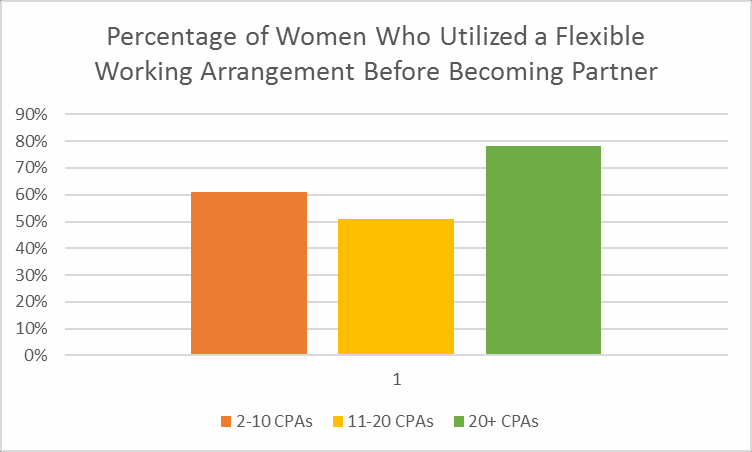

However, don’t assume that your firm’s advantage merely stops at recruiting new staff members. The Women’s Initiatives Executive Committee CPA Gender Survey of 2015, had a surprising insight into how effective a flexible work schedule can be to retain talented women on the path to becoming a partner.

As shown below, the preponderance of women of all firm sizes used a flexible work arrangement before becoming a partner.

The CIA also advertises alternative work schedules and hours, but, “as office needs permit.” They have also assembled Agency Resource Groups (ARGs) that range from a Deaf and Hard of Hearing Advisory Committee (DHHAC) to the Directorate of Analysis Women’s Council (DAWC). Additionally, they sponsor a child care facility with subsidies, a Student Loan Repayment Assistance Program (SLRAP), and continued education programs throughout an employee’s career. They also have potentially the coolest, and busiest, Starbucks on the planet. The baristas are required to pass extensive background checks, are escorted to and from their jobsite, and are forbidden from writing customer names on cups for reasons of security.

Never underestimate how seemingly minor amenities can give your firm a substantial edge. Leo Moretti, a partner in Rhode Island based YKSM CPAs detailed a story of how he tipped the odds in his favor. His firm was looking to make a new hire and was notified of a woman with eight years of accounting experience who would be moving to the area. Although several large firms in the area had made quite generous employment offers, Leo’s firm ultimately gained a very happy new senior accountant. How?

He emphasized the “family oriented” nature of his firm, use of a dedicated nursing room for this newmother, and the ability to have flexible and remote working arrangements. This successful hire prompted the firm to plan further office renovations to include: a female specific break room with a fully stocked lounge, Wi-Fi, comfortable furniture, and a more spacious nursing room.

Leo Moretti stated, “I have daughters of my own in the workforce, as do most of my fellow partners. We treat our staff like we would want our own family treated in the workplace. It’s just common sense these days.”

Rarely would we argue that suggestions from a government agency fall in the category of, “common sense.” Yet in this case, what’s good the CIA is good for CPAs. Using the million-dollar recommendations listed above can ultimately help accomplish two very important tasks. You can simultaneously hire more staff and ensure the future growth and viability of your firm in an increasing competitive market place.

Partner Action Items

Refine your Location: Look back at where your firm has successfully generated leads in the past and revisit the relationships your firm has at those locations. If you firm lacks relationships at local colleges and/or with career counselors, specific internet sites can greatly assist your firm with casting a wider net.

Determine who to send: Investigate your firm for qualified females who can sing the praises of your business while speaking with female candidates. Also, investigate your internal referral program to determine if this would be a good fit for your firm or can be expanded or refined.

Know your selling points: No firm is exactly like another. Determine what it is that set your firm apart. A focus group comprised of staff may be particularly useful for this task.

Advise your clients: As a trusted advisor to your clients, they seek help on manner of issues. If you have a professional services client who is struggling to hire more staff, they can likely adapt the principles above to enhance their odds of success as well.

For questions or speaking event requests, please contact:

Joseph Brunsman (joseph@cplbrokers.com) is the vice president of Chesapeake Professional Liability Brokers in

Annapolis, Md. He is a co-author of True Course: The Definitive Guide for CPA Practice Insurance.

Dan Hudson (dhudson@cplbrokers.com) is the president of Chesapeake Professional Liability Brokers in Annapolis, Md. He is a co-author of True Course: The Definitive Guide for CPA Practice Insurance.

Stephanie Hecklinski (stephanie@walkeragcy.com) specializes in Accountants Professional Liabilty at Walker & Associates in Indiana